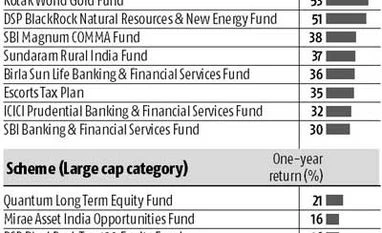

Particularly, several feeder funds with exposure to international markets have delivered stellar returns. Among domestic-focused stocks, several of the banking and finance-related funds have done much better than the diversified equity schemes. Such schemes have made returns in excess of 30 per cent.

In the large-cap category (barring the exchange-traded funds), schemes from small fund houses have occupied the top positions with Quantum's Long Term Equity Fund leading with a return of 21 per cent, followed by Mirae Asset's India Opportunities Fund which returned 16 per cent to the investors over the past one year. Not only have these funds performed better than their larger peers, but also did much better than the category average return of large-cap funds, which stood at less than 10 per cent.

You’ve reached your limit of {{free_limit}} free articles this month.

Subscribe now for unlimited access.

Already subscribed? Log in

Subscribe to read the full story →

Smart Quarterly

₹900

3 Months

₹300/Month

Smart Essential

₹2,700

1 Year

₹225/Month

Super Saver

₹3,900

2 Years

₹162/Month

Renews automatically, cancel anytime

Here’s what’s included in our digital subscription plans

Access to Exclusive Premium Stories

Over 30 subscriber-only stories daily, handpicked by our editors

Complimentary Access to The New York Times

News, Games, Cooking, Audio, Wirecutter & The Athletic

Business Standard Epaper

Digital replica of our daily newspaper — with options to read, save, and share

Curated Newsletters

Insights on markets, finance, politics, tech, and more delivered to your inbox

Market Analysis & Investment Insights

In-depth market analysis & insights with access to The Smart Investor

Archives

Repository of articles and publications dating back to 1997

Ad-free Reading

Uninterrupted reading experience with no advertisements

Seamless Access Across All Devices

Access Business Standard across devices — mobile, tablet, or PC, via web or app

)